How Bookmakers Make Money

Updated: 2025

One of the fundamental, appealing aspects of sports betting is that it’s possible to consistently make a profit. You need to know what you are doing and apply the right strategies, but it can be done. However, most bettors lose money in the long run. There are several reasons why this is the case, one of which is the fact that bookmakers use certain techniques to make sure they are always at an advantage.

Successful sports betting is basically about overcoming this advantage. Bookmakers are essentially your opponents, and you have to learn how to beat them. Before you can do this, you need to understand exactly how they are ensured to make money.

In this article, we explain the methods bookmakers use to give themselves the advantage. We also look at the other main reason why they make money: most bettors make bad bets.

So, How Exactly Are the Bookmakers Making Money?

Bookmakers make money by the following:

- They set the right bet prices (the vig)

- Setting and changing the betting lines

- Balancing the Book – Eliminating Risk

- Counting on Bettor Emotions and Lack of Knowledge

Basic Principle of Bookmaking

The basic principle of bookmaking is straightforward and pretty obvious. A bookmaker takes money in whenever they lay a bet to a customer, and they pay money out every time one of their customers wins a bet. The idea is to take more money in than pay out. The art of bookmaking is in making sure this happens.

Bookmakers can’t control the outcome of sports events, but they can control how much they stand to win or lose on any particular result. They set the odds for all the wagers they lay, which ultimately enables them to ensure a profit.

Charging Vigorish/The Overround

The main technique bookmakers use to put the odds in their favor is the inclusion of vigorish. Vigorish, or vig, is also known as juice, margin, or the overround. It is built into the odds bookmakers set to help them make a profit. In essence, it’s a commission charged for laying bets. To best explain vig, we’ll use a simple example of a coin toss.

The toss of a coin has two possible outcomes and each is equally likely. There is a 50% chance of heads and a 50% chance of tails. If a bookmaker were offering true odds on the toss of a coin, they would offer even money. This is 2.00 in decimal odds, +100 in moneyline odds, and 1/1 in fractional odds. A successful $10 bet at even money returns $20, which is $10 profit plus the initial stake back.

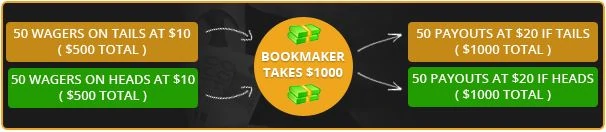

Let’s say this bookmaker had 100 customers all betting $10 on the toss of a coin, with half of them betting on tails and half of them betting on heads. The bookmaker would stand to make no money at all in this scenario.

As you can see from the above image, the bookmakers are taking in a total of $1,000 in wagers, but they also have to pay out a total of $1,000 in winnings whatever the result. Since they are in business to make money, this is obviously not a good scenario.

This is precisely why they build in the vig to the odds. They can thus guarantee, theoretically at least, that they will make money regardless of the outcome. When two outcomes are equally likely, it is common for them to use odds of 1.9091 (-110 in moneyline, 10/11 in fractional).

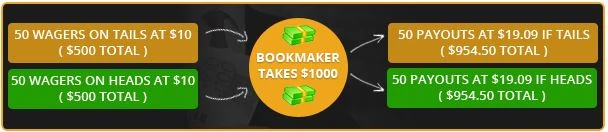

Continuing with the coin toss example, the odds on heads and tails would still both be the same, but they would now be at 1.9091. This means that a successful $10 would return a total of $19.09 ($9.09 in profit, plus $10 original stake).

Let’s see how that looks for the bookmaker now, with 50 customers betting on tails and 50 customers betting on heads.

As you can see, the change in odds has made a big difference, and the bookmaker is now making a guaranteed profit on every toss of the coin. The total amount they pay out is always going to be $954.50 against the $1,000 they have received in total wagers. Their built-in profit margin of $45.50 is the vigorish, or overround, and it’s usually expressed as a percentage of the total wagers received. In this case, the vig is equal to roughly 4.5%.

This is a very simplified example, but it does serve to illustrate how bookmakers set the odds to give them an advantage. Things get a little more complicated when it actually comes to sports events, as the possible outcomes aren’t usually equally likely. There are more than two possible outcomes in many betting markets, and bookmakers aren’t always going to take in exactly the same amount on all possible outcomes.

For these reasons, making money as a bookmaker isn’t as straightforward as simply charging vig. Other techniques are required to ensure consistent profits, and this is where the role of odds compilers comes in.

The Role of Odds Compilers

Odds compilers set the odds at bookmaking firms. They are also known as traders, and their role is absolutely essential. The odds they set eventually determine how much in wagers a bookmaker is likely to take in, and how much money they are likely to make. The act of setting the odds for a sports event is known as pricing the market.

There are a number of aspects involved in pricing up markets for sports events. The primary goal is to make sure the odds accurately reflect how likely any particular outcome might be, while also ensuring that there’s a built-in profit margin. Determining the likelihood of outcomes is largely based on statistics, but very often a certain amount of sports knowledge must be applied as well.

Compilers therefore have to be very knowledgeable about the sports for which they are pricing markets; thus, they often specialize in just one or two. They also have to have a solid understanding of various mathematical and statistical principles.

Let’s look at how a compiler might price up a market for a tennis match in which Novak Djokovic is playing Andy Murray. These two players are very close in ability, so the compiler would have to take a number of factors into consideration. They would look at current form, for example, and each player’s known ability on the relevant playing surface. They would also take the results of past meetings into account.

Based on all these factors, they might reach the conclusion that Djokovic has roughly a 60% chance of winning the match and Murray roughly a 40% chance. The odds that approximately reflect these chances are Djokovic at 1.67 and Murray at 2.50. These odds don’t include any vig, which would also need to be considered.

Generally speaking, compilers have a target margin. This may vary quite significantly for any number of reasons, but let’s assume in this case that the compiler wants around a 5% margin. They would reduce the odds for each player by 5%, giving 1.59 for Djokovic and 2.38 for Murray.

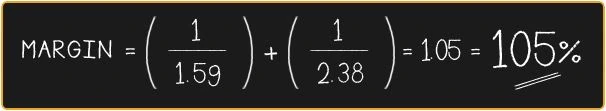

A bookmaker’s margin can be calculated by adding the reciprocal of the odds for all possible outcomes and converting it to a percentage. In this case, there are two possible outcomes, and the following equation would be used.

As you can see, the compiler has achieved the target of a 5% margin. However, the job doesn’t end there. Compilers also have to try and make sure that a bookmaker has a balanced book.

Creating a Balanced Book

When a bookmaker has a balanced book on a particular market, he stands to make approximately the same amount of money regardless of the outcome. With an imbalanced book, the outcome would affect how much is made, and it could even result in a loss. A balanced book is usually the preference, for obvious reasons, and is what odds compilers typically aim for.

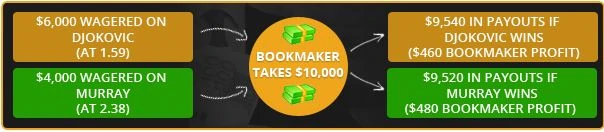

Continuing with the above tennis match example, a balanced book would look something like this.

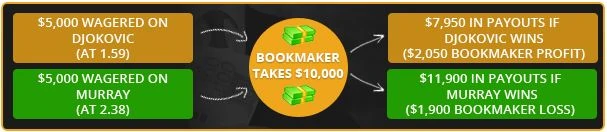

As you can see, based on $10,000 in total bets, the bookmaker stands to make roughly $500 regardless of the outcome. This is the target 5% margin. Let’s look at what would happen if that $10,000 in total bets was spread evenly on both players.

In this scenario, the bookmaker has an imbalanced book. He will make a profit if Djokovic wins, but will lose money if Murray wins. It’s usually a scenario to try and avoid.

This is why you see odds on sports events fluctuate over time. Odds compilers will continually adjust them to make sure their book is balanced. For example, in the above scenario, they could increase the odds on Djokovic to encourage more bets on his winning, or they could reduce the odds on Murray to discourage further bets on his winning. They could even do both.

There’s no guarantee that adjusting the odds will always create a balanced book, but it usually helps. This is one reason why the volume of bets is so important to bookmakers. As a general rule, more money coming in means they are more likely to get the balance right. It’s actually quite rare to get markets perfectly balanced; the goal is simply to get as close as possible.

It’s worth noting that sometimes odds compilers will actually want an imbalanced book. If they have confidence in a particular outcome, they will try to create a situation where they stand to make the most profit if it happens. If they are very confident that Djokovic could win the match against Murray, for example, they might decide to push the odds out on Murray to get more action on that side of the book.

Summary

It should now be clear why bookmakers have a mathematical advantage over their customers. They don’t always win money on every single market they price up, but this advantage does help to ensure they win money in the long run.

The advantage can be beaten, however. It’s not like casino games where the odds are always stacked against you no matter what you do. That being said, the mathematical advantage isn’t the only reason why bookmakers make money. Their success also comes down to the simple fact that most bettors place more bad than good bets.

To avoid being one of those bettors, you need to understand what actually makes for a good bet. Contrary to what many believe, a good bet isn’t simply betting on what you think might happen. Although this approach can be successful if you are accurate often enough in predicting the outcome of sports events, but the reality is that most people are not.

For the best chance of making money on sports betting, you need to be skilled in identifying betting opportunities that represent good value. This is the real key to consistent profits and something we explain more about in the next article.